There has been a dramatic increase in the significance of ship wrecks in recent years, the cost, the media attention, the political angle, big ship incidents are big news.

The following article is the full length version of an article previously contributed to IHS Maritime Fairplay's publication of 23 October 2014.

The rising cost of wreck removal

Only upwards

There has been a dramatic increase in the significance of ship wrecks in recent years, the cost, the media attention, the political angle, big ship incidents are big news.

It was not always the case that a wreck became a big issue, especially if it was located away from a shipping lane. Often they were left where they were, and nature took its course.

Change followed incidents like the MT TORREY CANYON in 1967 which was one of the first big shipping environmental disaster news stories that grabbed international headlines and started to focus the attention of governments on the risks and liabilities that follow from such an incident. It is of course also famous because of the attempt by the British military to "bomb" the vessel into pieces and burn off its oil cargo.

Modern incidents

Given the 24 hours nature of our world, and the fact that anyone with a smart phone can become an instant news reporter, plus a general public fascination with shipping incidents that dates back to the TITANIC, it is not surprising that a large ship in trouble, especially near a coast line, will attract a lot of attention.

The recent high profile cases of the MV COSTA CONCORDIA and the MV RENA are examples of this trend, with the two cases representing (at the time of writing) the largest and third largest P&I claims in history, with a possible final combined "bill" in excess of USD 2 billion.

That of course means more work for the salvors, and the International Salvage Union has reported that wreck removal has become a key profit source for the Industry. The growth in this sector has seen an increase in profits by a fivefold factor over the last 10 years with yearly profits now around USD 300 million.

So why so expensive?

There are a number of reasons for this and they can be summarised as follows:

- general inflation over the last 50 years (over 618% basis US CPI data)

- wrecks are often no longer just left where they lie

- improving technology makes the past "impossible" in to the present "possible ... and costly"

- larger ships, carrying more cargo (especially container vessels) mean more involved operations

- a modern focus on the environmental impact of not just the wreck, but also its removal

- the (mis-)understanding of contracts, not every type of contract is suitable for a wreck removal job

- underestimating the true extent of the job and its likely cost

- environmental lobbying

- political interest

- intervention of government authorities

- disparate regulatory regimes

- possible unlimited liability

Successfully managing the different interests that claim to have a stake in a wreck is difficult and requires a significant investment of time and effort. It also requires experienced hands to be in control of the situation as negotiations with government authorities can be particularly sensitive and need to be undertaken with care.

Impact on marine insurance

The losses of the MV RENA and MV COSTA CONCORDIA were significant to the hull market (especially the latter), but nonetheless the exposure was limited to the insurance values and terms.

From the P&I side the impact was much more significant as liabilities were a great unknown on day one, and even after a significant passage of time it proved very difficult to accurately estimate the likely final cost of either incident as new claims and demands were raised, at times from entirely unforeseen angles.

As a consequence, reinsurance costs have risen sharply in the last two years after falling before 2012. Today a passenger ship pays USD 3.7791 per g.t. for its International Group P&I reinsurance whereas in 2012 it had paid USD 1.3992, which represents an increase of 170%.

Other tonnage types were not immune and dirty tankers, dry cargo vessels (including container ships) as well as clean tankers have also seen costs increase by an aggregate of at least 20% or more.

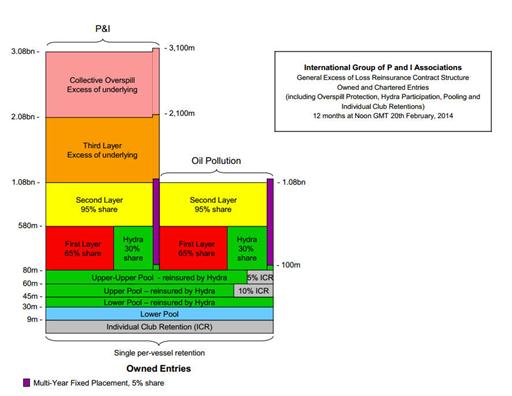

These increases have led to a further development of the International Group P&I's pooling and reinsurance programmes in order to keep more risk "in house" at the P&I level and thus manage the reinsurance costs being imposed on the shipowners.

Noteworthy changes are the increase of an individual club's retention to USD 9 million, the increase in the International Group pool to USD 80 million, and the greater involvement of the IG's captive Hydra in the first reinsurance layer.

Source: International Group of P&I Clubs

Increasing reinsurance costs will work their way down to individual shipowner's annual insurance costs per vessel and despite the depressed state of the shipping market, shipowners will need to seek to pass these on to their customers which will ultimately mean increased hire and freight rates (but without increased profit to owners).

That will translate in to higher costs of shipment, which ends up costing everyone that is a consumer of anything seaborne (i.e.: all of us). So by an extended route, an incident like the COSTA CONCORDIA may not just mean a higher ticket price for an ocean cruise, but could also translate in to a higher cost for a loaf of bread, a new TV or a tank of petrol!

Therefore ultimately we all pay for such an event, but given that we all benefit from shipping it is a justifiable outcome. Indeed it is no different to how all drivers and users of motor vehicle services ultimately pay for the cost of the insurance which pays for the claims of road traffic accidents.

The cost of the claim becomes part of the cost of the insurance which becomes part of the cost of the service, broadly speaking.

Managing a wreck removal

It would be beyond the scope of this article to set out a detailed exposition on how casualties need to be handled, or indeed to focus specifically just on the wreck removal element of such an event.

The following is therefore a brief summary overview of the kind of things that need to be kept in mind and where insurers do have a role to play, both hull and P&I:

- a quick appreciation of the nature and extent of the casualty - is she a "total loss"

- realistic assessment of the likely costs of salvage and / or wreck removal

- choosing the right service providers on the basis of appropriate contracts

- dedicate appropriate resources of manpower with experience to managing the incident response

- being prepared to load up costs at the front to make savings later

- a readiness to objectively review the situation, reassess it and implement changes that assist in staying up to speed with a possibly rapidly developing situation

Experience has shown that no two mega incidents are the same, and it is all too easy to point out issues with the benefit of hindsight. Effective casualty and wreck removal management is therefore down to having in place, in advance, the right people with the necessary experience and authority to make decisions and implement them.

That is something where the Skuld P&I Club can boast a strong track record.

The future

At present the trend is for a lower frequency of mega sized incidents, but a dramatically higher cost per incident than compared to historical experience.

The pending coming in to force of the Nairobi Convention (April 2015) will, however, add another angle to this story and it may mean that:

- more wreck removals will be ordered in the future

- such removals may take place in more challenging locations

- it may not always be possible to limit liability - although the Convention itself does not change an owner's right to limit, individual states can choose to opt "wreck removal" out of limitation regimes

Altogether it will mean that wreck removal, and its cost, remain and continue to be one of the key challenges for the shipping industry as a whole, and not just its insurers.